You've Been Logged Out

For security reasons, we have logged you out of HDFC Bank NetBanking. We do this when you refresh/move back on the browser on any NetBanking page.

OK- Home

- PAY Cards, Bill Pay

- Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- Visa CardPay

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- Cards

- Bill Payments

- Recharge

- Payment Solutions

- Money Transfer

- SAVE Accounts, Deposits

- INVEST Bonds, Mutual Funds

- BORROW Loans, EMI

- INSURE Cover, Protect

- OFFERS Offers, Discounts

- My Mailbox

- My Profile

- Home

- PAY Cards, Bill Pay

- Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- Visa CardPay

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- Cards

- Bill Payments

- Recharge

- Payment Solutions

- Money Transfer

- SAVE Accounts, Deposits

- INVEST Bonds, Mutual Funds

- BORROW Loans, EMI

- INSURE Cover, Protect

- OFFERS Offers, Discounts

- My Mailbox

- My Profile

- Home

- PAY Cards, Bill Pay

- Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- Visa CardPay

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- SAVE Accounts, Deposits

- INVEST Bonds, Mutual Funds

- BORROW Loans, EMI

- INSURE Cover, Protect

- OFFERS Offers, Discounts

- My Mailbox

- My Profile

-

content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/accounts.svg

Accounts

-

ThisPageDoesNotContainIcon

Savings Accounts

- How to Personalise Bank Account Number

- Family Savings Group Account

- Eligibility

- Documentation

- Fees & Charges

- Senior Citizens Savings Scheme Account

- Speciale Gold Women's Savings Account

- Fastag ACQ

- Women Savings Account Bengali

- Women Savings Account Hindi

- speciale-Senior-Citizen-savings-account

- Dc Offer Sept

- Regular Savings Account Tamil

- DigiSave Youth Account Bengali

- Savings Max Account Bengali

- Regular Savings Account Bengali

- Types Of Savings Accounts - Compare Savings Accounts Online

- Super Kids Savings Account

- ThisPageDoesNotCntainIcon Money Maximizer

- DigiSave Youth Account

- DigiSave Youth Account Hindi

- DigiSave Youth Account Tamil

- DigiSave Youth Account Marathi

- DigiSave Youth Account Telugu

- InstaAccount

- Insta Account Kannada

- Insta Account hindi

- Insta Account Bengali

- Insta Account Tamil

- Insta Account Marathi

- Insta Account Telugu

- Government Scheme Beneficiary Savings Account

- Speciale Gold and Speciale Platinum

- Specialé Activ Account

- Aadhaar Seeding Page

- Common Fees and Charges for Savings Account

- BSBDA - Basic Savings Bank Deposit Account

- Savings Farmers Account

- Institutional Savings Account

- Small Savings Account

- Digisave Youth Account Kannada

- DigiSave Youth Account Malayalam

- Regular Savings Accounts

- Regular Savings Accounts Hindi

- Regular Savings Account Mararthi

- Regular Savings Account Telugu

- Savings Max Account

- Savings Max Account Hindi

- Savings Max Account Tamil

- Savings Max Account Marathi

- Savings Max Account Telugu

- Women Savings Account

- Women Savings Account Tamil

- Women Savings Account Marathi

- Women Savings Account Telugu

- Kids Advantage Account

- Senior Citizen's Account

-

ThisPageDoesNotContainIcon

Salary Account

- Speciale Salary Account

- Salary Account

- Salary Account

- salary-accounts-hindi

- defence-salary-account-hindi

- regular-salary-account-hindi

- savings-bank-deposit-account-salary-hindi

- CSA Offers

- Corporate Salary Account IBM

- Corporate Salary Account Capgemini

- Corporate

- Corporate Salary Account

- Tax Season

- Save your taxes now to avoid last-minute panic

- Enjoy special offers for Government Personnel

- 7 Solutions to keep your Resolutions!

- Important information regarding your HDFC Bank Salary Account

- Wealth Create

- Wealth Protect

- Switch to Save

- Salary Family Account

- Anmol Salary Account

- Online Zero Balance Salary Account

- Reimbursement Account

- Veer Account

- Government Salary Account

- Regular Salary Account

- Premium Salary Account with Platinum Debit Card

- Salary benefits

- documentation-hindi

- Premium Salary Account with Millennia Debit Card

-

ThisPageDoesNotContainIcon

Current Accounts

- Regular Collection Account

- Biz Lite+ Account

- Biz Pro+ Account

- Premium Current Account

- Investments for CA customers

- Max Advantage Current Account

- Biz Ultra+ Account

- Biz Elite+ Account

- Ascent Current Account

- Activ Current Account

- Plus Current Account

- Regular Current Account

- Saksham Current Account

- Current Account For Professionals

- Agri Current Account

- Institutional Current Account

- RFC - Domestic Account

- Exchange Earners Foreign Currency (EEFC) Account

- Ultima Current Account

- Apex Current Account

- Max Current Account

- Supreme Current Account

- EZEE Current Account

- Trade Current Account

- Flexi Current Account

- Merchant Advantage Current Account

- Merchant Advantage Plus Current Account

- Current Account For Hospitals And Nursing Homes

- CSR Account

- vyapar-current-account

- RERA Current Account

- Startup Buildup

- e-Commerce Current Account

- Escrow Current Account Solutions

- Apply Online

- ThisPageDoesNotContainIcon Rural Accounts

- ThisPageDoesNotContainIcon PPF Account Online

- Garv Pension Saving Account

- ThisPageDoesNotContainIcon Savings Account Interest Rate

- content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/accounts.svg Merchant Services

-

ThisPageDoesNotContainIcon

Savings Accounts

-

content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/deposits.svg

Deposits

-

ThisPageDoesNotContainIcon

Fixed Deposit

- What is a Special Edition Fixed Deposit

- hdfc-bank-surecover-fd

- surecover-fixed-deposit

- terms-and-conditions

- eligibility

- surecover-fd-t-and-c

- Fixed Deposit

- Direct Deposit FD

- HDFC Bank HealthCover FD

- Goal Based Fixed Deposit Offer

- HealthCover Fixed Deposit

- Azadi Ka Amrit Mahotsav

- fd new year

- SweepIn Facility

- Overdraft against Fixed Deposits

- Regular Fixed Deposits

- Break Fixed Deposit

- Five Year Tax Saving Fixed Deposit

- FCNR Deposits

- Non Withdrawable Deposits

- Non withdrawal Deposits

- ThisPageDoesNotContainIcon Fixed Deposit Interest Rate

- ThisPageDoesNotContainIcon Recurring Deposit

- content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/dream_deposit.svg My Passion Fund

-

ThisPageDoesNotContainIcon

Fixed Deposit

- content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/safe_deposit_locker.svg Safe Deposit locker

- content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/high_networth_banking.svg High Networth Banking

Open Salary Account Online - Get great offers and Cashbacks!!!

Open a Salary Account

Open a Salary Account Zero Balance Account.

Zero Balance Account.

Premium Salary Account

Premium Salary Account Experience Premium Salary banking.

Experience Premium Salary banking.

Speciale Salary Account

Speciale Salary Account Experience Special Salary Account - Gold & Platinum.

Experience Special Salary Account - Gold & Platinum.

Premium Salary Account with Millennia Debit Card

Premium Salary Account with Millennia Debit Card Open a window to Premium Banking.

Open a window to Premium Banking.

Regular Salary Account

Regular Salary Account A Salary Account to help take small steps to a better future.

A Salary Account to help take small steps to a better future.

Veer Account

Veer Account An Exclusive banking experience for Defense Personnel.

An Exclusive banking experience for Defense Personnel.

Government Salary Account

Government Salary Account An Exclusive Salary Account for Government Personnel.

An Exclusive Salary Account for Government Personnel.

Family Salary Account

Family Salary Account Extend the Benefits of your Salary Account with your Family.

Extend the Benefits of your Salary Account with your Family.

Anmol Salary Account

Anmol Salary Account An exclusive Salary Account crafted for PSU Employees

An exclusive Salary Account crafted for PSU Employees

Opening a Salary Account with HDFC Bank goes beyond receiving your salary — it’s about enjoying a seamless and rewarding banking experience. From the very first day, you get convenient access to NetBanking, MobileBanking, BillPay, PayZapp and more, making money management effortless.

As a welcome privilege, you can earn rewards worth up to ₹2,000 by activating any 5 of 10 key services within 30 days of opening your account. These rewards include vouchers from leading brands like Swiggy, JioHotstar, Ixigo, PVR, and Amazon Pay, giving you instant value as you step into digital banking.

This festive season, add more joy to your celebrations with the Salary Account Onboarding Offer. Whether it’s a Diwali family gathering, a Dussehra movie night, or planning a special festive outing, HDFC Bank rewards are here to make every occasion more memorable.

Start your journey today with the HDFC Bank Salary Account — smart banking combined with greater rewards.

T&C Apply. Valid till 31st October.

To know more, click here.

Open Salary Account Online

Exclusive benefits of modern, customised banking services through your HDFC Bank Salary Account.

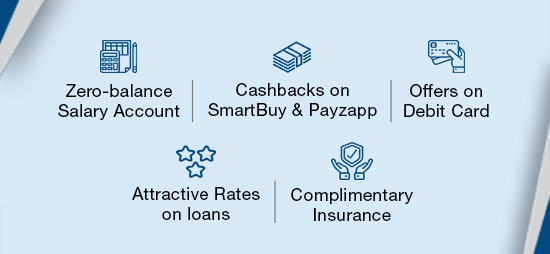

Enjoy zero-balance account with features such as :

- Offers with Debit Card, SmartBuy and PayZapp benefits.

- NetBanking, PhoneBanking, MobileBanking and Chat Banking.

- Make life simpler by using BillPay to pay utility bills and get instant alerts.

- Complimentary Insurance Benefits.

- Switch to Save

FAQs

How do I open a Salary Account?

You can open a Salary Account with HDFC Bank instantly. Visit the HDFC Bank website and under ‘Accounts’, select the online Salary Account opening option. Provide your Permanent Account Number (PAN), mobile number, employer details, address and KYC details. Ensure your Aadhaar is linked to your mobile number to complete Aadhaar-based KYC. The instant account is valid for a year. To convert it into a Regular Salary Account, visit the HDFC branch for in-person KYC.

What are the benefits of opening a Salary Account?

A Salary Account is a zero-balance account, i.e., no minimum balance is necessary. You enjoy direct salary credit into your bank account. You also enjoy debit and credit card facilities, chequebooks, internet banking, etc. Salary Account holders may also enjoy preferential loan terms.

What rate of interest can I earn on balances in my HDFC Bank Salary Account?

You can earn interest rates from 3.0% to 3.5% per annum.

What is the process to transfer my account from one HDFC Bank branch to another?

Duly fill out and sign the Account Transfer Form and submit it to the bank branch where you would like to transfer your account. Your account number remains the same, and you can continue using existing bank debit and credit cards and chequebooks.

What is the amount I need to maintain in a Salary Account?

Salary Accounts are zero-balance accounts, i.e., you are not required to maintain a minimum balance. Therefore, the bank does not charge a penalty for not keeping a minimum balance in your salary account.

Can I use my corporate Salary Account for other purposes?

Yes. You can use your Salary Account to finance fund transfers, open Fixed Deposits and get loans. You can also use the Salary Account details to open Demat accounts and finance Mutual Fund SIPs.

What are the documents required to open a Salary Account online?

Click here to know list of documents when applying for an HDFC Bank Salary Account

Read Our Customer’s Experiences

![]()

I’ve been using my HDFC Bank Salary Account for a while now, and it’s been really convenient. My salary gets credited on time every month and there’s no need to maintain a minimum balance, which means I don’t have to worry about transferring money around just to avoid charges.

- Aayush Anupam

![]()

The free ATM Card that comes with my account gives me airport lounge access, which is nice. The Mobile Banking app is convenient for checking transactions, bank statement, etc. Overall the banking experience is smooth and fast. I also have a relationship manager who I can reach out to any time for any queries and requests.

- Cynthia D'Souza

![]()

I've been using the HDFC Bank Salary Account and it's been smooth — no minimum balance needed, and I earn some interest too. The debit card comes with perks like lounge access and reward points, which I can easily redeem through NetBanking or PhoneBanking. I would recommend making the most of Cashback deals and PayZapp just like I do.

- Sameer Sahu