Benefits

Life and CI Rebalance

Under this plan option, Basic Sum Assured chosen by you will be split between Life Cover SA and Critical Illness SA (CI SA). At the beginning of the cover, Life Cover SA is set at 80% of Basic Sum Assured and CI SA is set at 20% of Basic Sum Assured. For an in-force policy, at every policy anniversary, starting from the rst policy anniversary, CI SA will increase every year and Life Cover SA will decrease by the same amount. This amount will be calculated as follows:

30% x Basic Sum assured / Policy Term

Basic Sum Assured (Life Cover SA + CI SA) will remain the same throughout the policy term

Example: for basic sum assured of ₹50 lakh and policy term of 10 years, benet structure will vary over the term as follows:

| Policy Year | Life Cover SA (₹) | CI SA (₹) |

| 1 | 40.0 lakh | 10.0 lakh |

| 2 | 38.5 lakh | 11.5 lakh |

| 3 | 37.0 lakh | 13.0 lakh |

| 4 | 35.5 lakh | 14.5 lakh |

| 5 | 34.0 lakh | 16.0 lakh |

| Policy Year | Life Cover SA | CI SA |

| 6 | 32.5 lakh | 17.5 lakh |

| 7 | 31.0 lakh | 19.0 lakh |

| 8 | 29.5 lakh | 20.5 lakh |

| 9 | 28.0 lakh | 22.0 lakh |

| 10 | 26.5 lakh | 23.5 lakh |

Once a Critical Illness claim is made, the Life Cover SA will be xed at the then applicable level and the same SA will continue until the end of policy term.

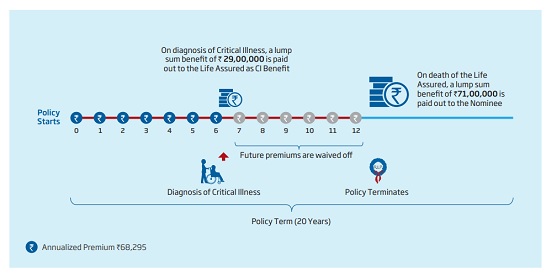

Example: Mr. Xavier, a 45 years old gentleman, buys the Life and CI Rebalance option of HDFC Life Click 2 Protect Life for a policy term of 20 years, regular pay, and avails a basic sum assured of ₹1,00,00,000. He pays a premium of ₹68,295 annually.

He is diagnosed with a Critical Illness in the 7th policy year. His future premiums are waived off and he receives ₹29,00,000 as lump sum Critical Illness benefit. His Life Cover SA is now xed at ₹71,00,000.

Mr. Xavier passes away in the 13th policy year. His nominee will receive a lump sum death benefit of ₹71,00,000.

Total Premiums Paid: ₹4,78,065

Death Benefit: “Death Benefit” is payable as a lump sum to your Nominee if you, the Life Assured die during the policy term.

It is the highest of:

- Sum Assured on Death

- 105% of Total Premiums Paid

- Life Cover SA

Sum Assured on Death for Single Pay (SP) is the higher of:

- 125% of Single Premium

- Sum Assured on Maturity

Sum Assured on Death for other than Single Pay (Limited Pay and Regular Pay) is the higher of:

- 10 times of the Annualized Premium

- Sum Assured on Maturity

Where, Annualized Premium is the premium amount payable in a year chosen by the policyholder, excluding taxes, rider premiums, underwriting extra premiums and loadings for modal premiums, if any.

Total Premiums Paid are the total of all the premiums received, excluding any extra premium, any rider premium and taxes. In case ROP option has been selected, Total Premiums Paid includes premium paid for base plan option and the additional premium paid for ROP option.

Sum Assured on Death is the absolute amount of Benefit which is guaranteed* to become payable on death of the life assured in accordance with the terms and conditions of the policy or an absolute amount of Benefit which is available to meet the health cover.

Basic Sum Assured is the amount of sum assured chosen by the policyholder. Sum Assured on Maturity is the amount which is guaranteed* to become payable on maturity of the policy, in accordance with the terms and conditions of the policy.

Benefit on diagnosis of Critical Illness:

On diagnosis of any of the covered critical illnesses, the applicable Critical Illness (CI) SA at the time of diagnosis of the disease, will be payable to you.

In addition, all future premiums payable under the plan will be waived and the life cover continues.

Please refer the section on “Critical Illnesses covered” for list of Critical Illnesses covered and definitions and exclusions relating to the same.

Maturity Benefit:

On survival until Maturity, Sum Assured on Maturity will be payable.

Sum Assured on Maturity will be equal to the Total Premiums Paid if ROP Benefit is selected, Nil otherwise.

Upon the payment of death or maturity Benefit as above, the policy terminates and no further Benefits are payable.

Life Protect

Under this plan option, you are covered for death during the policy term. In case of your unfortunate demise during the policy term, your nominee gets a lump sum benefit.

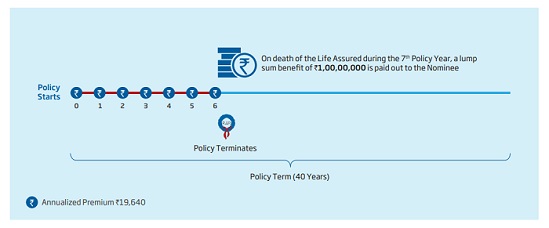

Example: Mr. Bansal, a 35 years old gentleman, buys the Life Protect Option of HDFC Life Click 2 Protect Life for a policy term of 40 years, regular pay, and avails a level cover of ` ₹1,00,00,000 by paying a premium of ₹19,640 annually.

Mr. Bansal passes away in the 7th policy year. His nominee will receive a lumpsum Benefit of ₹1,00,00,000. Total Premiums Paid:₹1,37,480

Death Benefit:

“Death Benefit” is payable as a lump sum to your Nominee if you, the Life Assured die during the policy term. It is the higher of:

- Sum Assured on Death

- 105% of Total Premiums Paid

Sum Assured on Death for Single Pay (SP) is the highest of:

- 125% of Single Premium

- Sum Assured on Maturity

Basic Sum Assured Sum Assured on Death for other than Single Pay (Limited Pay and Regular Pay) is the highest of:

- 10 times of the Annualized Premium

- Sum Assured on Maturity

- Basic Sum Assured

Maturity Benefit:

On survival until Maturity, Sum Assured on Maturity will be payable.

Sum Assured on Maturity will be equal to the Total Premiums Paid if ROP Benefit is selected, Nil otherwise.

Upon the payment of death or maturity Benefit as above, the policy terminates and no further Benefits are payable.

Income Plus

This option provides you with a life cover for the chosen policy term and regular monthly income from age 60 onwards along with a lump sum pay out on maturity. Monthly income of 0.1% of the Basic Sum Assured shall be paid in arrears, starting from the policy anniversary following your 60th birthday and continues until your death or policy maturity, whichever occurs earlier. The Survival Benefits already paid out shall be deducted from the Death Benefit payable to the Nominee

You may choose maturity ages as per the below table, subject to eligibility criteria mentioned above under Eligibility –

| Option | Fixed Term | Whole Life |

| Maturity Age | 70, 75, 80 or 85 years | Whole of Life |

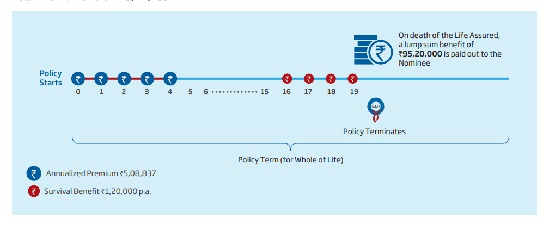

Example: Mr. Singh, a 45 years old gentleman, buys the Income Plus option of HDFC Life Click 2 Protect Life with premium payment term of 5 years and coverage for Whole of Life and avails a Basic Sum Assured of ₹1,00,00,000. He pays a premium of ₹5,08,837 annually.

He starts receiving regular monthly income of ` 10,000 from the start of 16th policy year (after attaining age 60 years).

He passes away in the first month of 20th policy year. His nominee will receive a lumpsum death benefit of ₹ 95,20,000.

Total Premiums Paid: Rs ₹25,44,185

Death Benefit:

“Death Benefit” is payable as a lump sum to your Nominee if you, the Life Assured die during the policy term. It is the higher of:

- Sum Assured on Death

- 105% of Total Premiums Paid less total Survival Benefits paid out till the date of death.

Sum Assured on Death for other than Single Pay (Limited Pay and Regular Pay) is the highest of:

- 10 times of the Annualized Premium

- Sum Assured on Maturity

- Basic Sum Assured

Survival Benefit:

On your survival during the policy term provided all due premiums have been paid, an income equal to 0.1% of Basic Sum Assured will be payable to you at the end of every month, following policy anniversary after your attaining age 60 years, until death or end of the policy term, whichever occurs first.

Maturity Benefit:

For Fixed Term: On Survival until Maturity, Sum Assured on Maturity will be payable.

Sum Assured on Maturity will be equal to Max (110% of Total Premiums Paid less total Survival Benefits paid out, 0)

For Whole Life: NIL

Upon the payment of death or maturity Benefit as above, the policy terminates and no further Benefits are payable.

Add-on bene¬fits available under the Product:

1.Return of Premium (ROP) option

You may choose to opt for this benet under plan option as per below table:

| Option | Allowed to opt for ROP option? | |

| Life and CI Rebalance | Yes | |

| Life Protect | Fixed Term | |

| Whole Life | No | |

| Income Plus | Fixed Term | |

| Whole Life | ||

If you choose this plan option, you will have to pay an additional premium over and above the premium payable for the base plan option chosen and you will receive a return of 100% of the Total Premiums Paid as a lump sum, upon survival until maturity.

This add-on option will be available for:

- All policy terms between 10 and 40 years for Single, Regular and 5 Pay.

- All policy terms between 15 and 40 years for 8, 10 and 12 Pay.

1. Waiver of Premium on CI (WOP CI) Option

If you choose this add-on option, all future premiums payable under the plan will be waived, if you, the life assured are diagnosed with any of the covered critical illnesses.

This option will be available only where PPT is at least 5 years and Life Protect Option with Fixed Term is selected.

An additional premium (over and above the premium payable for the base plan) will be payable if this add-on option is chosen.

3. Accidental Death Benet (ADB) Option

If you choose this add-on option, an additional amount equal to 100% of Basic Sum Assured will be payable to the Nominee on your (Life Assured’s) death due to accident during the policy term. This option will be available only where Life Protect Option has been selected.

An additional premium (over and above the premium payable for the base plan) will be payable if this add-on option is chosen.

4. Alteration of premium payment frequency

You have an option to alter the premium payment frequency during the premium payment term without any charge/ fee.

5. Option to reduce Premium Payment Term from Regular Pay to Limited Pay

You also have an option to convert the outstanding regular premiums into any limited premium period available under the plan options without any charge/ fee.

Non-Payment of Premiums

Grace Period is the time provided after the premium due date during which the policy is considered to be in-force with the risk cover. This plan has a grace period of 30 days for yearly, half yearly and quarterly frequencies from the premium due date. The grace period for monthly frequency is 15 days from the premium due date.

Should a valid claim arise under the policy during the grace period, but before the payment of due premium, we shall still honor the claim. In such cases, the due and unpaid premium for the policy year will be deducted from any benefit payable.

Upon premium discontinuance, if Unexpired Risk Premium Value is not acquired then the policy lapses without any value.

If a policy has acquired Unexpired Risk Premium Value, all benefits such as death, maturity and survival benefits, whether ROP benefit has been selected or not, will be reduced as follows:

Surrender

Unexpired Risk Premium Value (Surrender Value) gets acquired immediately upon payment of premium in case of SP and upon payment of premiums for 2 years in case of LP or RP. Unexpired Risk Premium Value will be calculated as follows:

For Income Plus Option or Return of Premium Option:

Unexpired Risk Premium Value will be the higher of Guaranteed Surrender Value (GSV) and Special Surrender Value (SSV), payable subject to the policy acquiring Unexpired Risk Premium Value.

Where,

GSV = GSV Factor% * Total Premiums Paid - Survival Benefits or ROP instalment Already Paid

The GSV will be floored to 0.

Where Income Plus Option has been selected:

SSV = ((SSV F1 Factor% x Basic Sum Assured) + (SSV F2 Factor% * Sum Assured on Maturity)) * Total Premiums Paid / Total Premiums Payble

And where ROP option has been selected:

SSV = SSVF2 Factor% x Total Premiums Paid

For details on GSV and SSV factors, please consult your financial advisor

For Life Protect Option (Whole Life):

Other than Income Plus Option, Life Protect Option (Whole Life) and Return of Premium Option:

Unexpired Risk Premium Value for LP/SP1 =

Surrender Value for RP = Nil

- If you have exercised the option to change premium payment term, Total Premiums Paid will include only premiums paid from the date of converting to Limited Pay and Original Policy Term will be the outstanding policy term on the date of converting to Limited Pay.

Please note:

- For the purpose of calculation of Unexpired Policy Term, only full calendar months shall be considered.

- For the purpose of computation of Unexpired Risk Premium Value, the Premiums shall exclude any applicable taxes and levies paid in respect of this Policy.