You've Been Logged Out

For security reasons, we have logged you out of HDFC Bank NetBanking. We do this when you refresh/move back on the browser on any NetBanking page.

OK- Home

- PAY Cards, Bill Pay

- Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- Visa CardPay

- Cards

- Bill Payments

- Recharge

- Payment Solutions

- Money Transfer

- SAVE Accounts, Deposits

- INVEST Bonds, Mutual Funds

- BORROW Loans, EMI

- INSURE Cover, Protect

- OFFERS Offers, Discounts

- My Mailbox

- My Profile

- Home

- PAY Cards, Bill Pay

- Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- Visa CardPay

- Cards

- Bill Payments

- Recharge

- Payment Solutions

- Money Transfer

- SAVE Accounts, Deposits

- INVEST Bonds, Mutual Funds

- BORROW Loans, EMI

- INSURE Cover, Protect

- OFFERS Offers, Discounts

- My Mailbox

- My Profile

- Home

- PAY Cards, Bill Pay

- Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- Visa CardPay

- SAVE Accounts, Deposits

- INVEST Bonds, Mutual Funds

- BORROW Loans, EMI

- INSURE Cover, Protect

- OFFERS Offers, Discounts

- My Mailbox

- My Profile

- Personal

- Resources

- Learning Centre

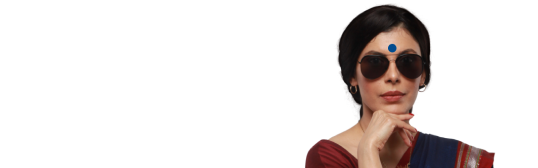

- Vigil Aunty

- What are Fake IVR Calls

What are Fake IVR Calls? The New Fraud Targeting Your Money

12 March, 2025

Synopsis

- Fraudsters use automated phone calls to fake legitimate IVR systems, tricking people into revealing sensitive information.

- During these calls, look out for red flags such as requests for personal information, urgent language and unfamiliar numbers.

- If you suspect a fraud, report it immediately by visiting cybercrime.gov.in or calling 1930.

With technology growing daily, fraudsters are also becoming smarter and more cunning. They constantly come up with new ways to deceive people and steal their hard-earned money. A fraud that is growing rapidly nowadays involves fake IVR calls, which pose a serious threat to your financial security. This article will explain IVR fraud, how it works and how you might protect yourself.

How Do Fake IVR Calls Work?

IVR fraud is a growing threat where fraudsters use automated phone fraud to steal sensitive information. IVR technology is commonly used by banks, telecom providers, and customer service helplines. It allows callers to interact with the system through voice commands or keypad inputs—for instance, pressing "1" for account information or "2" for customer support.

Fraudsters exploit this technology by creating fake IVR calls that mimic legitimate ones. These fake systems trick people into revealing confidential information like bank details, card numbers, or OTPs (One-Time Passwords). This is one of the most prevalent types of IVR fraud that target unsuspecting victims.

How Do Fraudsters Exploit IVR Systems?

Fraudsters use fake IVR systems to collect sensitive information through deception. Here's how they operate:

Fake Bank Calls: You receive a call that appears to be from a trusted institution like a bank. The automated phone fraud claims there is an issue with your Account or an urgent transaction needing verification.

Request for Sensitive Details: The fake IVR prompts you to enter personal information, such as your Debit/Credit Card number, PIN, CVV, or OTP.

Data Theft: Once you provide these details, fraudsters gain access to your Bank Account and may carry out unauthorised transactions.

Call Disconnection: After gathering your information, the call might suddenly disconnect, leaving you unaware of the breach until it is too late.

How to Identify Fake IVR Calls?

Spotting a fake IVR call can be easier if you know what to look for. Here are some red flags:

Requests for Sensitive Information: Legitimate IVRs do not ask for confidential information like OTPs, PINs, CVVs, or passwords. If you encounter this, it may be a fraud.

Urgent or Threatening Language: Fraudsters often create a sense of urgency and warn of severe consequences if you do not act immediately.

Unfamiliar Numbers: Always verify the contact number. Cross-check it with the official number listed on the company's website.

Pressuring Tactics: Genuine customer service agents will not rush or pressure you to share information.

Inconsistent Call Quality: Fake IVR calls may sound less polished or professional compared to official ones.

How to Protect Yourself from Fake IVR Fraud?

You should follow these practices to protect yourself from IVR fraud:

Never Share Sensitive Information: Avoid entering confidential details like OTPs, PINs, or CVVs during automated calls.

Enable Alerts: Activate SMS and email alerts for all your financial transactions to monitor unauthorised activities.

Verify Caller Identity: Always confirm a caller's identity by contacting the organisation through its official customer service number.

Register for DND: Sign up for Do Not Disturb (DND) services to limit spam and fraudulent calls.

Stay Informed: Regularly update yourself on emerging fraud through official websites and cybercrime resources.

Document the Fraud: Keep records of all communications, including phone numbers, call times, and any details shared.

Report Suspicious Activity: Inform your bank and the relevant authorities if you receive a suspicious call.

Stay Vigilant: One Call Can Make Your Bank Balance Fall…to ZERO!

In today's digital age, fraud is becoming more advanced and harder to detect. Fraudsters are using IVR phishing methods through fake IVR calls to exploit unsuspecting individuals. Hence, staying informed and cautious may help you protect your hard-earned money.

If you suspect a fraud, report it immediately. Call 1930 or visit cybercrime.gov.in to take action. Additionally, stay vigilant of this new IVR call fraud and join Vigil Army to update yourself against the latest financial fraud. Send a 'Hi' on 72900 30000 on WhatsApp to join.

*Disclaimer: Terms and conditions apply. The information provided in this article is generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances.