You've Been Logged Out

For security reasons, we have logged you out of HDFC Bank NetBanking. We do this when you refresh/move back on the browser on any NetBanking page.

OK- Home

- PAY Cards, Bill Pay

- Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- Visa CardPay

- Cards

- Bill Payments

- Recharge

- Payment Solutions

- Money Transfer

- SAVE Accounts, Deposits

- INVEST Bonds, Mutual Funds

- BORROW Loans, EMI

- INSURE Cover, Protect

- OFFERS Offers, Discounts

- My Mailbox

- My Profile

- Home

- PAY Cards, Bill Pay

- Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- Visa CardPay

- Cards

- Bill Payments

- Recharge

- Payment Solutions

- Money Transfer

- SAVE Accounts, Deposits

- INVEST Bonds, Mutual Funds

- BORROW Loans, EMI

- INSURE Cover, Protect

- OFFERS Offers, Discounts

- My Mailbox

- My Profile

- Home

- PAY Cards, Bill Pay

- Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- Visa CardPay

- SAVE Accounts, Deposits

- INVEST Bonds, Mutual Funds

- BORROW Loans, EMI

- INSURE Cover, Protect

- OFFERS Offers, Discounts

- My Mailbox

- My Profile

- Personal

- Resources

- Learning Centre

- ThisPageDoesNotCntainIconInvest

- 50 30 20 Rule for Budgeting

What is the 50-30-20 Rule for Budgeting?

27 March, 2025

Synopsis

Managing money effectively is essential for financial stability, and a structured budgeting approach can make a significant difference.

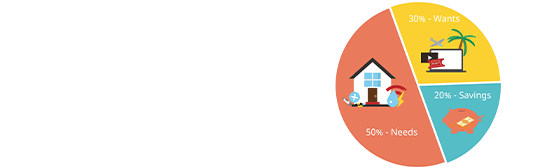

The 50/30/20 rule simplifies budgeting by dividing income into 50% for needs, 30% for wants, and 20% for savings and investments.

This method helps individuals balance their expenses, enjoy their lifestyle, and secure their financial future without unnecessary stress.

Tracking expenses, automating savings, and using innovative financial tools like the HDFC Bank SmartWealth App may make budgeting effortless and effective.

Imagine a boy named Raj, a 30-year-old marketing professional who earns ₹1,00,000 per month. Despite a decent salary, he often struggles to save and manage expenses. Unexpected bills throw his finances off track, and he barely has any savings. After so much frustration, Raj looks for a simple yet effective way to manage his money. Then, he learns about the 50/30/20 rule- a budgeting principle that transforms his financial habits.

What is the 50/30/20 Rule?

The 50/30/20 rule is a straightforward and effective method to allocate your income efficiently. The rule suggests dividing your after-tax income into three categories:

50% for Needs: Essential expenses like rent, groceries, utilities, insurance, and loan payments.

30% for Wants: Lifestyle expenses such as dining out, shopping, entertainment, and vacations.

20% for Savings and Investments: Emergency funds, retirement savings, and wealth-building investments.

This strategy will ensure you can cover your necessities, enjoy life, and secure your financial future without unnecessary stress. As a person’s liabilities and debt reduce over time, you may not use the whole 50% on needs and 30% on wants so that you can save and invest more of your money in that scenario.

Why Should You Follow the 50/30/20 Rule?

Simplicity: No complex calculations are needed. To manage expenses effortlessly, follow three clear categories.

Financial Stability: This ensures you can pay for essential things without running out of money before your next paycheck.

Flexibility: Adaptable to different income levels and personal investment objectives.

Future Security: Encourages consistent savings and investments, preparing you for emergencies and long-term stability.

How to Implement It Effectively?

Track Your Income & Expenses: You can use a budgeting app or track manually to understand your spending habits.

Automate Savings: Set up auto-transfers for investments and savings to avoid the temptation of spending.

Adjust As Needed: If your needs exceed 50%, cut down on wants until financial stability is achieved.

Use Smart Tools: Use platforms like the HDFC Bank SmartWealth App to automate savings, track investments, and optimise financial planning effortlessly.

By sticking to the 50/30/20 rule, Raj gradually overcame his financial struggles. His savings grew, his expenses became manageable, and he even started investing in wealth-building opportunities. Like Raj, you may achieve financial freedom by adopting this simple yet powerful budgeting rule.

Take control of your money today! Download the HDFC Bank SmartWealth App and plan a secure, stress-free future.

Disclaimer: This communication has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. HDFC Bank Limited ("HDFC Bank") does not warrant its completeness and accuracy. This information is not intended as an offer or solicitation for the purchase or sale of any financial instrument / units of Mutual Fund. Recipients of this information should rely on their own investigations and take their own professional advice. Neither HDFC Bank nor any of its employees shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the information contained in this material. HDFC Bank and its affiliates, officers, directors, key managerial persons and employees, including persons involved in the preparation or issuance of this material may, from time to time, have investments / positions in Mutual Funds / schemes referred in the document. HDFC Bank may at any time solicit or provide commercial banking, credit or other services to the Mutual Funds / AMCs referred to herein.

Accordingly, information may be available to HDFC Bank, which is not reflected in this material, and HDFC Bank may have acted upon or used the information prior to, or immediately following its publication. HDFC Bank neither guarantees nor makes any representations or warranties, express or implied, with respect to the fairness, correctness, accuracy, adequacy, reasonableness, viability for any particular purpose or completeness of the information and views. Further, HDFC Bank disclaims all liability in relation to use of data or information used in this report which is sourced from third parties.

HDFC Bank is an AMFI-registered Mutual Fund Distributor & a Corporate Agent for Insurance products.